cares act stimulus check tax implications

Tax Cuts and Economic Stimulus. This loan has allowed many small businesses to stay afloat during the sudden economic recession in 2020 and its.

Will The Stimulus Money Be Deducted From Your Refund Next Year Kgw Com

Under the Coronavirus Response and Relief Supplemental Appropriations Act of 2021 the second relief plan to expand unemployment unemployment benefits were extended by issuing 300 a week.

. You Didnt Get Your PPP Loan What. Here well cover everything from whats on your Equifax credit report to the nuances of how credit scores can help better your everyday life not to mention potentially making milestone purchases less complicated. Professional members receive one live or on-demand 1 or 2 CPE webinar per membership year when using code FREECPE at check-out.

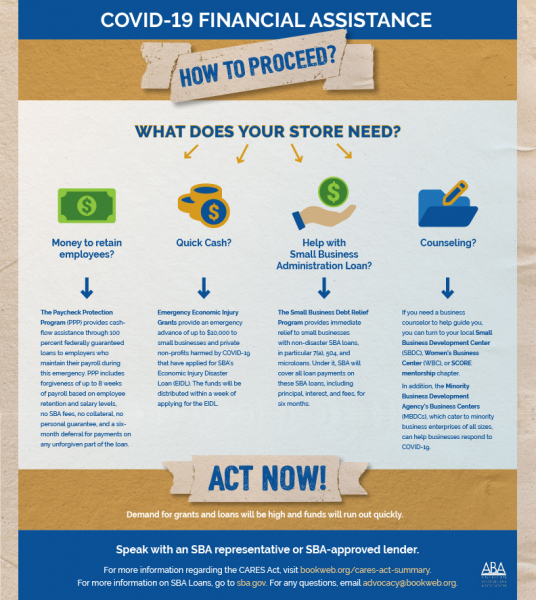

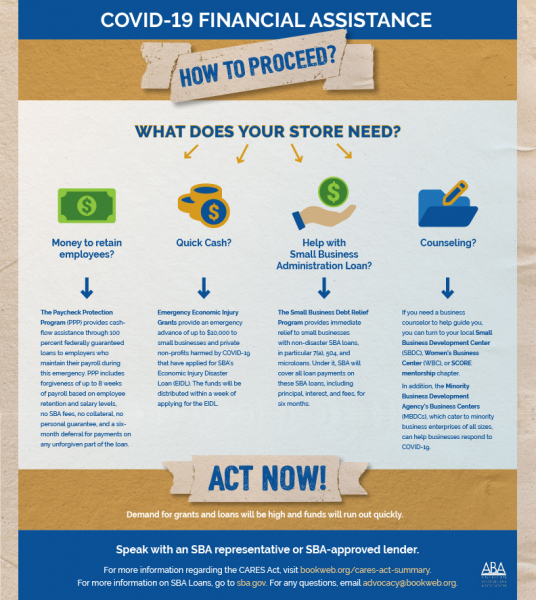

The Knowledge Center at Equifax. TurboTax CDDownload Products. The Coronavirus Aid Relief and Economic Security Act CARES Act programs offered a much-needed lifeline for many businesses in 2020.

The federal Coronavirus Aid Relief and Economic Security Act CARES ACT Consolidated Appropriations Act 2021 and American Rescue Plan Act of 2021 contained a number of tax provisions that impact the computation of taxable income for individuals and businesses modify eligibility for certain tax credits and. Software updates and optional online. This CARES Act provision was designed to provide relief to the many businesses that have to continue paying interest on preexisting loans or have had to take on.

1799 the PPP Extension Act of 2021 extending the application period through May 31 2021. Now that its tax time business owners who took advantage of these programs will want to know how the CARES Act relief affects their taxes. How Effective Are the Alternatives updated May 14 2020.

Congress passed the Paycheck Protection Program PPP loan as part of the Coronavirus Aid Relief and Economic Security CARES Act to provide fast and direct economic assistance for small businesses and to preserve jobs for Americans. Premium members receive the Premium Online Education Pass which includes access to all of these listed webinars. The CARES Act has given temporary payment relief to borrowers with qualifying federal student loans.

The first round of stimulus measures announced on March 12 amounted to A176 billion and included a one-off stimulus payment to welfare recipients accelerated depreciation deductions expansion of applicable eligibility criteria for instant asset write-offs cash flow assistance for businesses and financial support including tax and fee waivers to sectors regions and. SBA Application for Second Draw Loan HR. If your income rose in 2021 or you otherwise received more than you.

Additional 484 Billion Coronavirus Interim Relief Package Replenishes PPP. Exploring the world of money and the impact that money decisions have on our everyday lives has always been more than just a job for me. However the Coronavirus Aid Relief and Economic Security Act or CARES Act allowed taxpayers who dont itemize to deduct cash donations of up to 300.

Specifically the new rules let you tap into your retirement savings without penalty if you meet certain criteria up to a generous maximum of 100000. A line for determining how large of a recovery rebate aka stimulus check you might be owed in 2021 is also listed on the Form 1040. 7 a loan program.

The first 10200 of 2020 unemployment benefits are nontaxable if the household. This Act may be cited as the Coronavirus Aid Relief and Economic Security Act or the CARES Act. 31 2021 SBA Application for First Draw Loan.

What Considerations Should Lenders be Aware of Before Borrowers Apply for Loan Forgiveness. Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. Ive been obsessed with personal finance for more than 15 years now.

Interim Final Rule Mar. The economic impact payments also known as the stimulus payments are a provision of the CARES Act and later the Consolidated Appropriations Act and ARPA that provided advance payments of the temporary 2020 and 2021 Recovery Rebate Credit. 12 2021 Paycheck Protection Program Loans.

COVID-19 Updates Impacting Employers. A new Congress will be sworn in on on Sun. Economic Effects CRS Insight May 13 2020.

The second round of stimulus payments were authorized on December 27 2020 as part of the Consolidated Appropriations Act 2021. This deduction is available again for the. DIVISION ASMALL BUSINESS INTERRUPTION LOANS.

Eligible individuals and their qualifying dependents started receiving the third stimulus check of 1400. Even if you continued to make payments on your federal student loan the interest rate is 0. The CARES Act changed all of the rules about 401k withdrawals.

The House of Representatives passed the CASH Act however efforts for a 2000 second stimulus check are effectively dead. The Coronavirus Aid Relief and Economic Security Act also known as the CARES Act is a 22 trillion economic stimulus bill passed by the 116th US. You should also review the tax implications of being newly self-employed and learn about the different kinds of 1099.

An Overview of Federal Criminal Law. The payments began phasing out at the same income levels as the current payments but the maximum income. Nonprofits Dont Overlook Your Potential Refund Under the Employee Retention Tax Credit Mar.

CARES Act Payments Use and Recipient Characteristics. The CARES Act however temporarily loosened restrictions under 163j by allowing businesses to deduct interest expenses of up to 50 percent of EBITDA for tax years 2019 and 2020. Additional fees apply for e-filing state returns.

You might have heard that the CARES Act stimulus bill relaxes rules around taking 401k loans and IRA withdrawals. Governor Pritzker Extends the Illinois Stay at Home Order through May 30 2020. If your 2021 income is lower than the 2019 or 2020 income used to determine your eligibility earlier this year you can potentially claim additional stimulus money on your tax return.

Heres everything you need to know. In Brief July 24. As a result of Stimulus 3 and the American Rescue Plan Act ARPA the taxation of unemployment income benefits changed in reference to 2020 Federal returns.

Are the payments that individuals received in 2020 from the federal government ie 1200 2400 for individuals filing a joint return and 500 per qualifying child under the federal CARES Act or the 600 payments individuals receive from the federal government under the Coronavirus Response and Relief Supplemental Appropriations Act of 2021 subject to California income tax. If you have questions about your credit cards from applying for new credit cards to best practices for getting out of credit card. E-file fees do not apply to New York state returns.

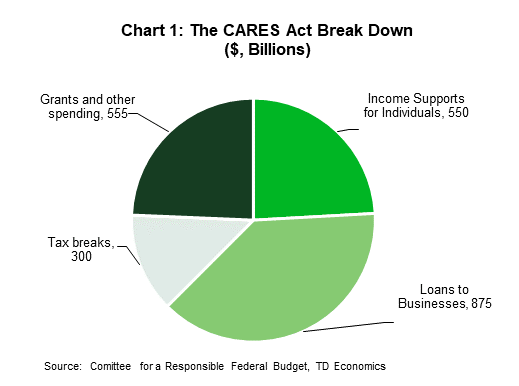

Overview and Considerations for Congress May 14 2020. While payments helped you pay down your debt it did not pay interest and will not count toward the tax deduction that allows you to deduct up to 2500 in student loan. The spending primarily includes 300 billion in one-time cash payments to.

Dipping into your retirement account can mean quick access to cash but its not a decision you. Tax Webinar of Choice. Expanded unemployment benefits under the CARES Act included an additional 600 per week in unemployment until July 31 2020 and allowed self-employed to file for unemployment.

The table of contents for this Act is as follows. CARES Act Stimulus Package Summary. Those payments typically totaled 600 per person or 1200 for married individuals plus 600 for each qualifying child.

Savings and price comparison based on anticipated price increase. New York State tax implications of recent federal COVID relief. The Senate passed on the House-passed CASH Act which would have increased the second-round stimulus checks approved by the COVID-Related Tax Relief Act from 600 to 2000.

Congress and signed into law by President Donald Trump on March 27 2020 in response to the economic fallout of the COVID-19 pandemic in the United States. Before COVID early withdrawals from your retirement accounts came with stiff penalties.

The Cares Act A Simple Summary Bench Accounting

Reporting Cares Act Benefits On Taxes H R Block

Cares Act Summary The American Booksellers Association

The Cares Act Provides Material Support To Households And Businesses

Understanding Economic Impact Payments And The Child Tax Credit National Alliance To End Homelessness

Cares Act 2021 Tax Incentives Aopa

The Impact Of The Cares Act On Economic Welfare Bfi

Cares Act Provisions For Financial Advisors And Their Clients

Cares Act Provisions For Financial Advisors And Their Clients